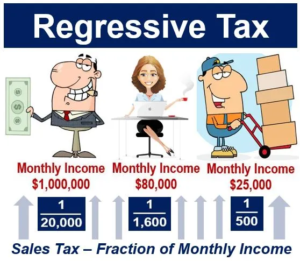

Regressive Tax in Taxation

A regressive tax is a tax imposition that is applied uniformly, taking a larger percentage of income from low-income earners than from high-income earners. It is generally characterized by low rates for high-income earners and high rates for low-income earners. The term regressive can refer to either taxes or tax systems. A regressive tax system is one where the effective rate of taxation decreases as the amount subject to taxation increases.